Building a Secure Credit Application for an Easy Financing Process

We partnered with Ironhorse Funding to build a secure credit application that allows consumers to pre-qualify for financing or refinancing of motorcycles, powersports vehicles, personal watercraft, and RVs.

The Client

Ironhorse Funding is a leading provider of innovative, technology-driven, full-credit spectrum finance solutions to consumers and dealers in the motorcycle, powersports, RV, and marine markets.

In contrast to the automobile industry, where specialized lenders are abundant, the motorcycle, RV, powersport, and marine markets have fewer financing options. Although local credit unions are a common choice for consumers seeking financing, Ironhorse Funding stands out among the limited number of national lenders as one of the only ones to offer direct-to-consumer financing.

The Vision

The Ironhorse Funding team processes thousands of applications per month that come in from consumers applying both directly and from its dealer networks.

With very few national lenders offering D2C lending options in this space, Ironhorse Funding saw an opportunity for growth by improving the consumer experience, starting with a quick and easy pre-qualification process.

Ironhorse Funding’s vision was to provide a stand-out pre-qualification experience and streamlined self-paced online experience for consumers — all integrated seamlessly within its Salesforce ecosystem.

The Challenge

One major challenge was standing in the way of achieving Ironhorse Funding’s goal — the inability to run soft credit pulls to pre-qualify applicants. Instead, consumers were required to provide a social security number (SSN), which would result in a hard credit pull right away.

Additionally, Ironhorse Funding couldn’t capture partial application data. If an applicant started an application and left, its current system couldn’t capture the information needed to follow up on that interaction.

The Ironhorse Funding team ultimately chose LaunchPad Lab as their digital product partner based on our expertise in Salesforce integration.

The Approach

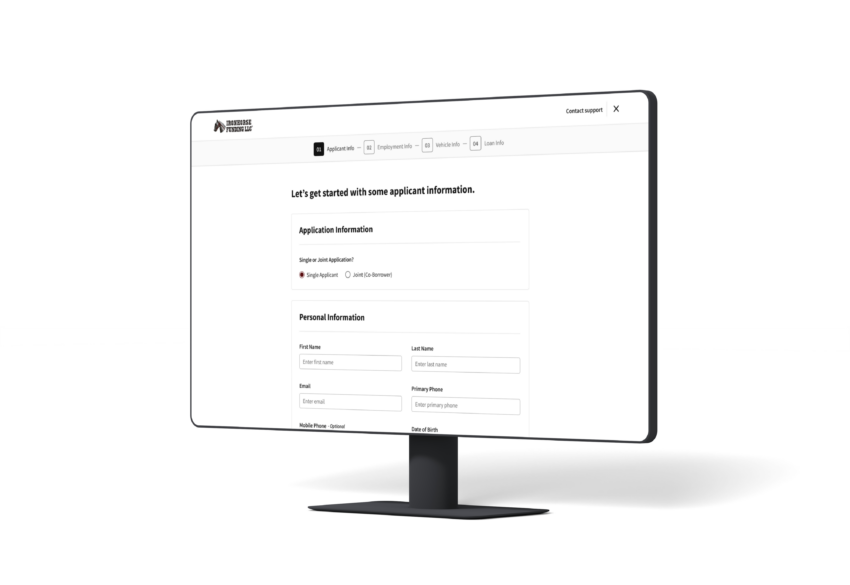

Once we understood Ironhorse Funding’s vision and challenges for this project, we focused on the core product: a landing page for consumer application submissions and a stepped loan application form that makes it easy to apply to finance a new purchase or refinance an existing loan. By capturing consumer applications and integrating that information directly into Salesforce, the Ironhorse Funding team would save time and boost efficiency.

Additionally, with a consumer-facing portal, Ironhorse Funding would be able to offer consumers more self-serve options. Not only would the portal make the application process easier, but it would also allow consumers to move through the application and close their loans at their own pace — even outside of typical Ironhorse Funding hours.

The Solution

LaunchPad Lab developed a front-end application that provides instant pre-qualification results without needing an SSN or affecting the consumer’s credit score.

This allows customers to see if they pre-qualify and provides details of their personalized loan offers, including rates and term length options. By giving the consumer more visibility into multiple offers, they can see at a glance how a shorter or longer term might affect their APR and monthly payment.

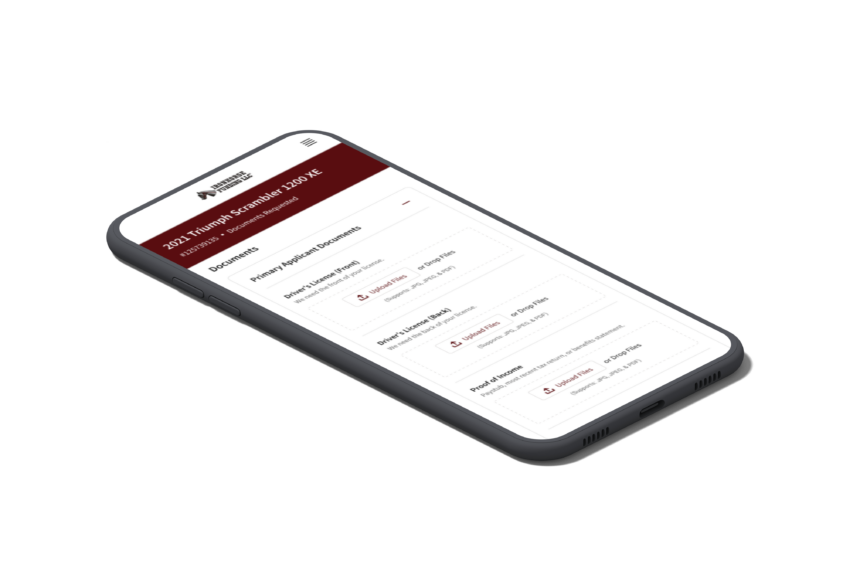

From there, consumers can choose the best option for them and move directly into the consumer portal to complete the loan process. Within the portal, consumers can also easily upload required documentation from their computer or mobile device. For example, a customer who has been approved can use their mobile device to take a photo of their ID and upload/submit it to Ironhorse Funding’s team.

The LaunchPad Lab team also enabled the ability for Abandoned Application Lead Capture and Activity Tracking to empower the Ironhorse Funding marketing and sales efforts.

By implementing a new front-end application fully integrated with Salesforce, Ironhorse Funding is well-prepared to support the future expansion of its customer experience.

Technologies Used

-

Experience Cloud

Experience Cloud integrates seamlessly with Salesforce to provide personalized experiences, powered by other Salesforce products.

-

Sales Cloud

Ironhorse Funding benefits from full integration with Sales Cloud as a hub for leads, opportunities, and users.

-

JD Power

A specialized technology for motor reviews and ratings, JD Power pulls data on makes, models, and VIN lookup.

-

DecisionLender

DecisionLender is utilized by Ironhorse Funding in the loan origination process, and was built out by API to evaluate applications and pass decision info back and forth to consumers through Salesforce.

Architecture Overview

The Outcome

Fueled by a new secure credit application and seamless Salesforce integration, the partnership with Ironhorse Funding yielded impressive outcomes and results, simplifying its consumer application process and customer experience:

-

Fast Pre-Qualification Responses

The pre-qualification process allowed applicants to receive swift responses on their loan eligibility, reducing the waiting period and enhancing customer satisfaction.

-

Reduced Overall Sales Cycle

The streamlined and efficient user platform led to a reduction in the overall sales cycle time. By automating various steps in the lending process and providing quick access to multiple loan offers, Ironhorse Funding was able to guide applicants through their options faster and convert leads into customers more effectively.

-

Enhanced Self-Serve Capabilities

Ironhorse Funding’s consumer-facing portal significantly improved self-service options, allowing customers to independently manage their financing process. This portal enables users to complete applications, upload documents, and review loan options at their own pace. This not only streamlines the customer experience but also reduces the workload for Ironhorse Funding’s staff, enhancing overall efficiency and customer satisfaction.

-

Streamlined Internal Processes

The integration of Sales Cloud, JD Power, and DecisionLender contributed to the streamlining of internal processes. The automation of soft credit pulls, data validation, and lead management reduced manual work for Ironhorse Funding’s team members, enabling them to allocate their time more strategically.

-

Empowered Marketing and Sales Efforts

The Abandoned Application Lead Capture and Activity Tracking features helped empower the marketing and sales teams at Ironhorse Funding. Now, they can internally track and have a lead record in Salesforce for “abandoned applications”. The LaunchPad Lab team also developed training and coaching for Ironhorse Funding’s Salesforce team to ensure they were confident in managing the platform.

The collaboration between Ironhorse Funding and LaunchPad Lab resulted in a streamlined solution that not only met the immediate requirements of enabling direct-to-consumer lending but also positioned Ironhorse Funding for future growth and success.

Through the combination of advanced technologies and a user-centric approach, Ironhorse Funding achieved faster loan processing, improved customer experiences, and greater operational efficiency — ultimately solidifying its position as a leader in the finance solutions market for motorcycles, powersports vehicles, personal watercraft, and RVs.

Ready to Build Something Great?

Partner with us to develop technology to grow your business.